Introduction:

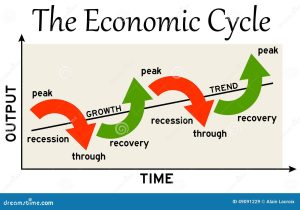

The organization world is carefully related to the state of the monetary gadget. It is essential for clients, enterprise owners, and marketers to recognize the industrial enterprise cycle. The business enterprise cycle, it actually is crafted from increase, top, contraction, and trough ranges, has a first-rate impact on the sector of finance. We will take a look at the intricacies of the enterprise cycle and the way specific stages could probable have an impact on your profits margin in this blog article.

Phases of the Business Cycle:

There are 4 number one degrees of the commercial enterprise cycle: increase, top, contraction, and trough. The financial gadget is growing, agencies are doing properly, and purchaser spending is developing during the growth segment. The economic pastime reaches its maximum at the height, and then it slows and sooner or later declines. Reduced customer spending, a slowdown in organization increase, and diminishing monetary interest are the hallmarks of the recession length. The cycle’s lowest factor, or the trough, opens the door for a subsequent expansionary segment.

Impact on Consumer Spending:

One of the number one forces inside the returned of economic hobby is patron spending, which varies in lockstep with the agency cycle. Consumer optimism about the future drives better expenditure on services and products during the increase duration. But, customers usually will be predisposed to lessen on non-important expenditure in the course of a recession, which has an impact on groups that rely on discretionary spending. Businesses want to understand these changes in consumer conduct so one can alter their method efficiently.

Employment Trends:

Employment patterns are in large part stimulated through the financial organization cycle. Businesses thrive within the path of durations of economic prosperity, which activates a upward push in hiring to preserve up with name for. On the alternative hand, in a recession, organizations can also want to take charge-cutting steps that result in system losses and an boom inside the unemployment charge. Understanding those tendencies is essential for entrepreneurs and business owners to cope with hard work control efficiently.

Interest Rates and Financing:

Central banks have a massive effect at the industrial agency cycle via imposing economic insurance. Central banks may growth interest expenses in an expansionary length of the monetary device so as to manipulate inflation and hold the financial system from overheating. In assessment, important banks can also select to reduce hobby costs at the way to encourage borrowing and expenditure in the course of a downturn. The fee of funding for corporations is without delay impacted through these hobby price swings, which has an impact on their bottom line.

Investment Opportunities:

Investors searching out profitable opportunities need to have a sturdy understanding of the commercial enterprise cycle. During specific cycles, a few sectors outperform others. Technology and client discretionary equities, as an instance, have to do well at some point of an boom, but purchaser staples and healthcare may want to possibly fare higher in the route of a downturn. Astute customers apprehend that the us of a of the economic system may moreover have a large impact on investment returns and modify their portfolios for that reason to take benefit of these dispositions.

Supply Chain Challenges:

Variations inside the financial cycle can cause supply chains to break, that might have an impact on how products and services are produced and distributed. Increased call for in the course of expansionary instances also can located strain on supply networks, sometimes resulting in delays and shortages. On the opportunity hand, at some point of contractions, organizations can also see decrease orders and surplus inventory, that can have an effect on manufacturers and companies.

Risk Management and Contingency Planning:

Given the inherent uncertainties of the commercial enterprise company cycle, groups need to build danger management and contingency planning into their technique. Businesses also can create backup plans to lessen the effects of downturns within the financial gadget thru reading beyond traits and economic signs and symptoms. This may also additionally entail spreading out the forms of products furnished, decreasing expenses, and preserving some coins on hand to climate any downturns inside the monetary gadget.

Conclusion:

Navigating the constantly moving financial currents is much like statistics the organisation cycle. Knowing the variations some of the increase, top, contraction, and trough degrees also can help traders, employer proprietors, and marketers make clever judgments. Businesses may additionally additionally climate monetary cycles and discover boom possibilities even in hard times by way of manner of retaining a watch fixed on monetary signs and symptoms and symptoms, adjusting techniques, and embracing innovation.